The New York City Real Estate Regional Center is approved by the USCIS to recruit immigrant investors who want to participate in EB-5 Program. The license is effective as of April 3, 2012. The amended license was approved on October 31, 2017 along with the pre-approval of the Operr Project. Currently, NYCRERC has a 100% approval rate of all filed I-526 and I-829 petitions.

NYCRERC's proven EB-5 track record and years of experience make us a reliable partner for those willing to immigrate to the United States. We only develop our own projects which allows for better control over the investment and job creation process. We vet our partners/vendors carefully and are committed to create economically feasible, financially sound, and transparent EB-5 investment projects that can be successfully funded by eligible foreign investors, who will achieve successful immigration outcomes.

Since the inception, we have delivered on our promises to EB-5 investors by running a successful project in New York that met the immigration requirements of the EB-5 program and allowed investors to receive their green cards in expedited manner (sooner than investors affiliated with other EB-5 regional centers).

For more information and a free consultation, please feel free to contact us at

contact@nycrerc.com

You can speak with a specialist during regular business hours using the chat in the bottom right part of your screen.

Monday - Friday

10:00am - 6:00pm EST

Because the Regional Center has a practice of pre-screening the lawful source of investment funds of potential investors, we maintain a 100% USCIS approval rate of I-526 investor petitions.

Our project involve the development and commercialization of transportation related software. In addition to software, the project also includes the purchase and operation of up to two parking facilities.

To date, all components of our EB-5 businesses are fully operational and are creating revenue sufficient to repay all EB-5 loans in a timely manner. The Regional Center is in compliance with all USCIS requirements.

To date, the project has created the minimum of 10 direct jobs for all our approved investors. One of our projects currently employs over 100 employees without assistance from the federal government.

The NYCRERC has seen much success and has kept up with the job creation policies for the EB-5 program and continues to stimulate the economy by assisting current and potential investors.

The data released by the New York City Tourism Bureau indicates that the number of tourists in NYC reached 50 million people in 2011. This guarantees excellent market prospects for car service industry.

The U.S. investment immigration EB-5 regional center program was reauthorized and there is no waiting time for certain categories of EB-5 visa!

It was established by the U.S. government to attract foreign investment to create job opportunities and stimulate U.S. economic growth. The EB-5 program has a total quota of 10,000 visas each year, aiming to encourage foreign investors to obtain US green cards through investment.

There are two ways to make an EB-5 Investment:

Additionally, there is a possibility of adjustment of status with the concurrent filing with I-5126E petition which is a great advantage for those investors who are already in the United States on different types of visas. While filing for adjustment does not provide any status, it does allow for the Employment Authorization Document ("EAD") to be issued along with a travel document (advanced parole).

(Attorney fees may vary depending on whether our in-house counsel or your own personal attorney is retained.)

In order to improve the timing of green card adjudication, USCIS has established a more efficient process for the EB-5 program:

Investors can submit I-526E and I-485 at the same time but the conversion of status will happen after I-526E is approved. But while pending, investors can legally work in the U.S. and travel outside of the country.

All EB-5 investors MUST submit the Suitability Evaluation Form in order to apply for the petition. Questions include but are not limited to the following:

Operr Funding Group, L.P. is a commercial New York State limited partnership (the "Partnership") that was formed to finance the development of the Project with EB-5 investment funds. The Partnership is designed to comply with the statutory and regulatory requirements of the EB-5 Program. The Partnership is registered at the same TEA location of the Regional Center. Each EB-5 investor will become a limited partner in the Partnership upon his or her subscription to one unit in the Partnership and execution of the Subscription Agreement, the Limited Partnership Agreement, and the Escrow Agreement if applicable per the respective investor's choice. Each limited partner will contribute a $800,000 capital investment, as well as a $80,000 administrative fee to the Regional Center in its capacity as the General Partner of the Partnership. Investors as LPs of the Funding Group have the option to select the loan model or the equity model to participate in this project. The Partnership will loan the funds to Operr Group to finance project development, and the administrative fee will be used to pay for expenses incurred in conducting the business for recruiting investors and other related costs.

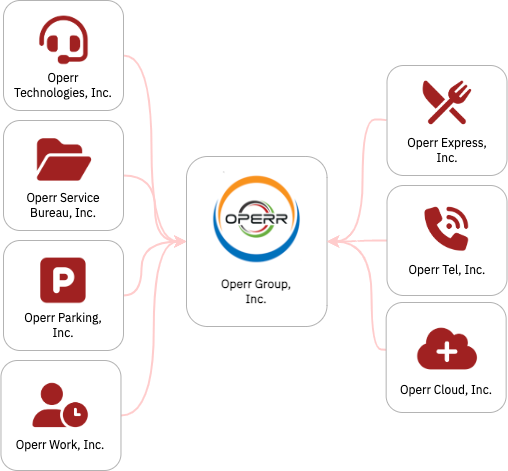

The project is development and commercialization of various Management Business to Business (B-B) and Business to Customer (B-C) Software, provision of cloud-computing services and call center operations etc. Operr Funding Group, LP., the new commercial enterprise ("NCE"), is formed for project realization. The Operr Project will develop and market software that will address the shortcomings of the transportation industry while improving business operations. The Company will also offer cloud services, parking and business management solutions. The company goal is to become one of the leading B-B software solution providers in the U.S. and globally.

In 2021, the company was nominated "Top 20 Most Promising Transportation Management Software Providers in the United States" by CIO Review and "Top 30 Fabulous Companies of the Year" by Silicon Review. In addition, it is also awarded the ""nnovation Excellence Award 2023" by Success Knocks Magazine.

Website: https://www.operrgroup.com

Equity Model

NOTE: Investors must keep their capital invested with and through the "new commercial enterprise" (NCE) until the day the conditions on their conditional Green Card are removed.

Operr Technologies, Inc. Founded on November 6, 2013, as the leading comprehensive vehicle dispatching service software provider in New York State.

Operr Service Bureau, Inc. Founded on May 24, 2018, as the leading NEMT (Non-emergency Medical Transportation) Billing Service provider in New York State.

Operr Parking, Inc. Founded on May 6, 2021, as the leading garage operation management software provider in New York State.

Operr Tel, Inc. Founded on March 16, 2018, as the leading VOIP (Voice over Internet Protocol) Business phone service software provider in New York State.

Operr Work, Inc. Founded on March 16, 2018, as the leading Employee Management software provider in New York State.

Operr Express, Inc. Founded on November 5, 2018, as the leading delivery and restaurant related service software provider in New York State

Operr Cloud, Inc. Founded on April 20, 2018, as the leading Cloud service provider to support all our software platforms and any other third parties' cloud service demand in New York State.

Mr. D'Arminio is serving as a Chairman of the Regional Center from 2015 and he is a former Mayor of the Township of Saddle Brook . He has over 40 years serving the public in government...

Mr. Wang has more than 10 years of experience in operating the Regional Center, a double Master of Laws degree in both China and the United States; a registered lawyer in the state of New York...

Graduated from Boston University Questrom School of Business, he received his JD in law from Touro College and he will soon receive his Masters in Computer Information Systems...

With more than 8 years of professional experience in software development, Mr. Zhang has a technical background and a Master of Science degree from New York University...